Welcome to

M A P Insurance® Beta is innovating in smart contract parametric insurance.

1.

Smart Contracts

Terms of the policy are agreed by all counterparties and are coded into smart contracts and cannot be changed without the parties knowing.

3.

Execute and Value Transfer

Smart contract policy is automatically executed based on the pre-agreed terms.

M A P Insurance®

Smart Contract Credit Scores

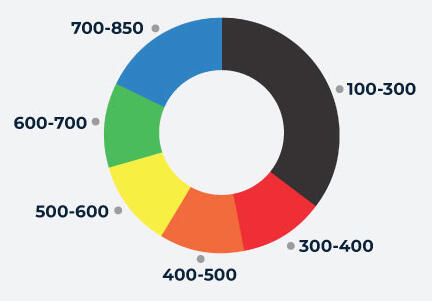

Credit scores apply to smart contracts and are reported as a number, ranging from 300 to 850. Map Insurance will provide a credit score for users of Digital Tax Stamps. To learn more visit taxmap.io.

M A P Insurance®

Trade Credit Insurance

Trade credit insurance provides cover for businesses if

customers who owe money for products or services do not pay

their debts, or pay them later than the payment terms

dictate. It gives businesses the confidence to extend credit

to new customers and improves access to funding, often at

more competitive rates. Trade credit insurance is for

products and services that are due within 12 months.

With trade credit insurance, the policyholder knows their

business is protected against both commercial and political

risks that are beyond their control knowing that money owed

to them will be paid. This helps firms to grow profitably,

supporting them at all stages of the business cycle and

minimising the risk to them of unexpected customer

insolvency.

Trade credit insurers will generally cover two types of

risk that a business can include in their cover:

-

Commercial risk - the risk that your customers are unable to pay the outstanding invoices because of financial reasons, for example, declared insolvency or protracted default.

-

Political risk - non-payment as a result of events outside the policyholder or customer’s control, for example, due to political events (wars, revolutions); disasters, (earthquakes, hurricanes); or economic difficulties, such as a currency shortage so are unable to transfer money owed from one country to another.

Contact us

© MAP Insurance. All rights reserved.